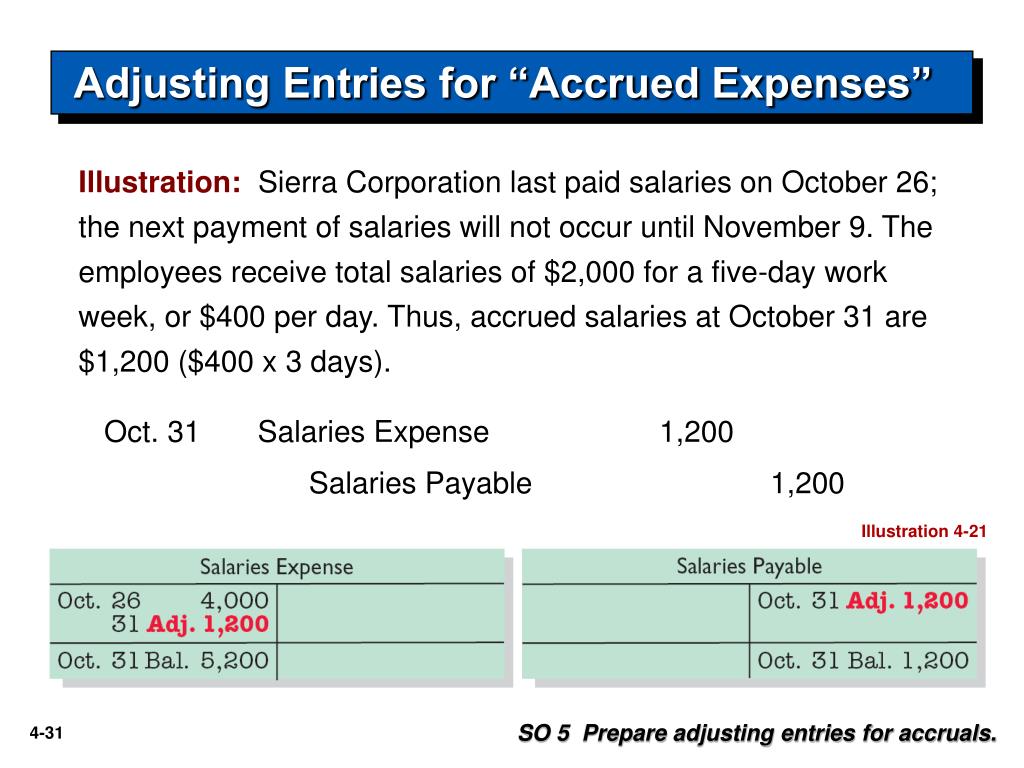

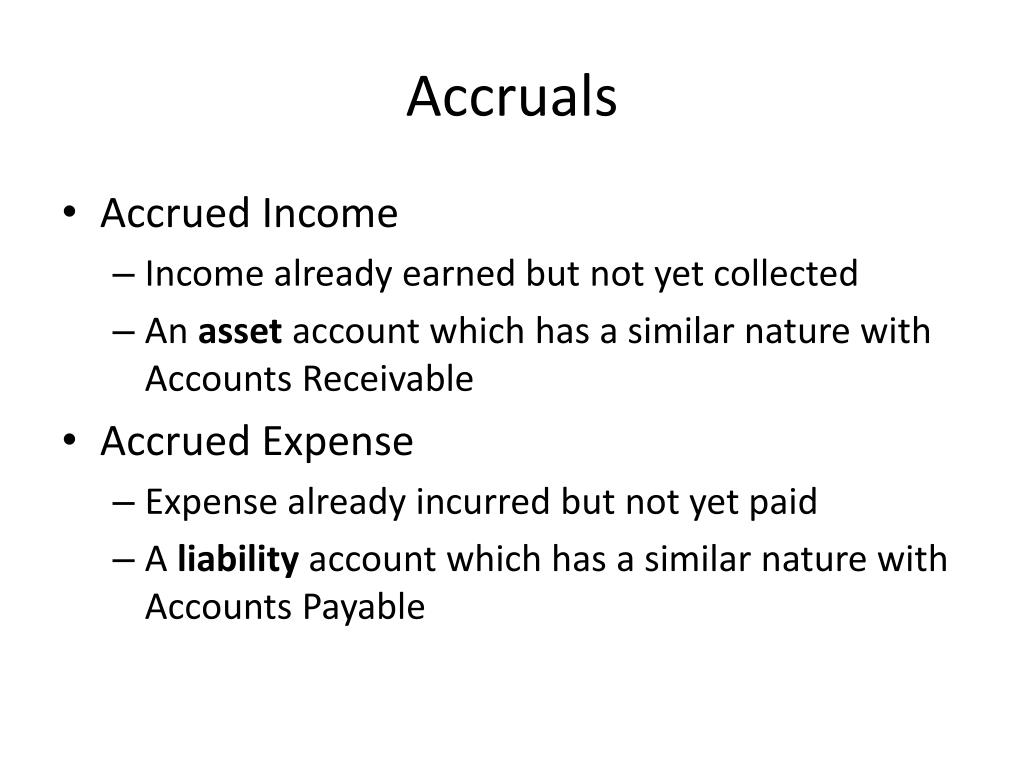

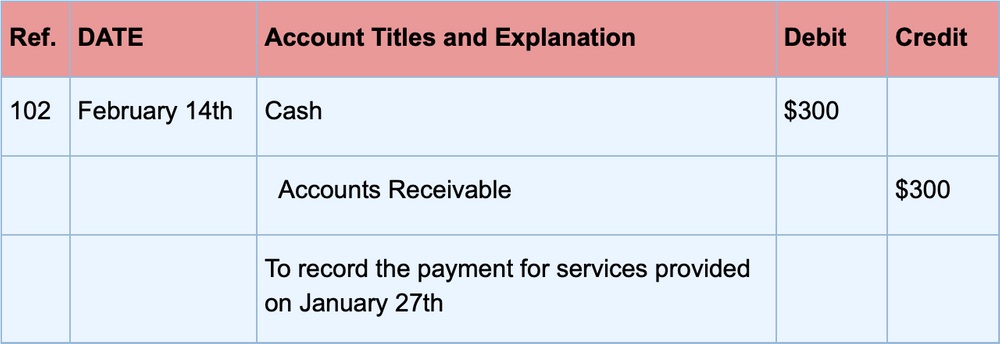

By the end of the lease term, the deferred rent balance will be reduced to zero, as the total cash paid and expense incurred over the life of the lease is equal. When the cash paid is greater than the straight-line expense, the accumulated deferred rent will be reduced each period by the excess of cash paid over the expense incurred. This can be assumed because straight-line rent expense is the average of all required payments. If there are periods where the straight-line expense is greater than cash paid, deferred rent is recorded and accumulated, to be relieved later in the term. Over the entire lease term, total cash payments will equal the total expense incurred. The additional rent expense is “delayed” or deferred to be recognized at a later date. Deferred rent occurs in periods where the expense incurred is greater than cash paid for rent. Since the rent expense is an average, there will be months where cash is more than the straight-line expense and correspondingly months where cash is less than the expense. When a lease term has rent holidays, prepayments, rent escalations, or de-escalations, there will be periods the actual cash being paid (or not paid) is different from the average of total lease payments to be made over the term of the lease. Whenever the rent is paid, the accrued rent will be reduced by the amount paid.ĭeferred rent is the result of rent expense being recorded on a straight-line basis when cash paid for rent escalates or de-escalates over the term of the lease. The act of recognizing the expense when the company is obligated to pay for the use of the asset but before payment is made is called accruing the expense. For example, if payments are made quarterly at the end of the quarter, expense will need to be recorded each month, before payment. While accrued rent occurs when the timing of rent expense incurred differs from when payments are due, deferred rent is a result of a difference in the amount of the straight-line expense recognized and cash paid for rent in the reporting period.Īccrued rent is caused by a timing discrepancy between the expense being incurred and recorded. Typically accrued rent is recorded for the use of a building or property that has not yet been paid for. Companies can be charged rent for any type of asset they utilize. Accruals are important because they help to ensure that a company's financial statements accurately reflect its true financial position, even if it has not yet received payment for all of the services it has provided or paid all of its bills.Accrued rent is a liability that represents the obligation incurred for the use of an asset owned by a third party. This can include things like unpaid invoices for services provided, or expenses that have been incurred but not yet paid.

Accruals are created by adjusting journal entries at the end of each accounting period.Īn accrual is a record of revenue or expenses that have been earned or incurred but have not yet been recorded in the company's financial statements.This is the preferred method of accounting according to GAAP.

0 kommentar(er)

0 kommentar(er)